Why your customers are ghosting your brand and searching for solutions instead

The British high street is not dying. It is being remapped by consumers who no longer care about your brand name as much as they care about the product in their basket. If it feels like customers are ghosting your brand, they are not disappearing. They are simply starting their journey with a problem to solve, not a logo to find. This shift has profound implications for how you attract demand, allocate budget and measure success.

A clear shift towards mission-led shopping

According to the latest Metis data, the UK homeware sector shows a striking divergence in behaviour. Search volume for specific products is up 7.54% year on year, while brand-specific search has barely moved, growing by just 0.05%. This tells you exactly how the modern shopper thinks. They are searching for a mattress topper, a sofa or a bedside table first. Only after that do they decide which retailer deserves their money.

As the year progresses, search demand continues to focus on home renewal and sleep quality. Some brands interpret flat brand search as a warning sign. In reality, it is a significant opportunity for non-brand capture. If you are not visible for high-intent product terms, the risk is simple. You become invisible to customers who are actively problem-solving rather than browsing for familiar names.

Speed is now a competitive advantage

Metis evaluates these trends weekly, four times faster than traditional SEO tools. This has already highlighted sharp increases in searches around home office furniture and wellness-adjacent products. This speed allows you to pivot content, SEO and PR strategies while competitors are still waiting for end-of-month reports. In a market driven by intent, reacting late often means missing the opportunity entirely.

Why Share of Wallet changes the picture

Understanding demand within your own category is no longer enough. Share of Wallet offers a broader view by showing how consumers divide their discretionary income across sectors.

By grouping major retail categories, Metis reveals whether a homeware shopper is choosing a new sofa or being tempted away by travel deals, fashion drops or electronics. For you as a CMO or marketing leader, this perspective is essential. You are not just competing with similar retailers. You are competing with every other sector for a finite household budget. Metis data gives you the evidence to see whether your investment is genuinely shifting demand in your favour or whether the market is moving elsewhere.

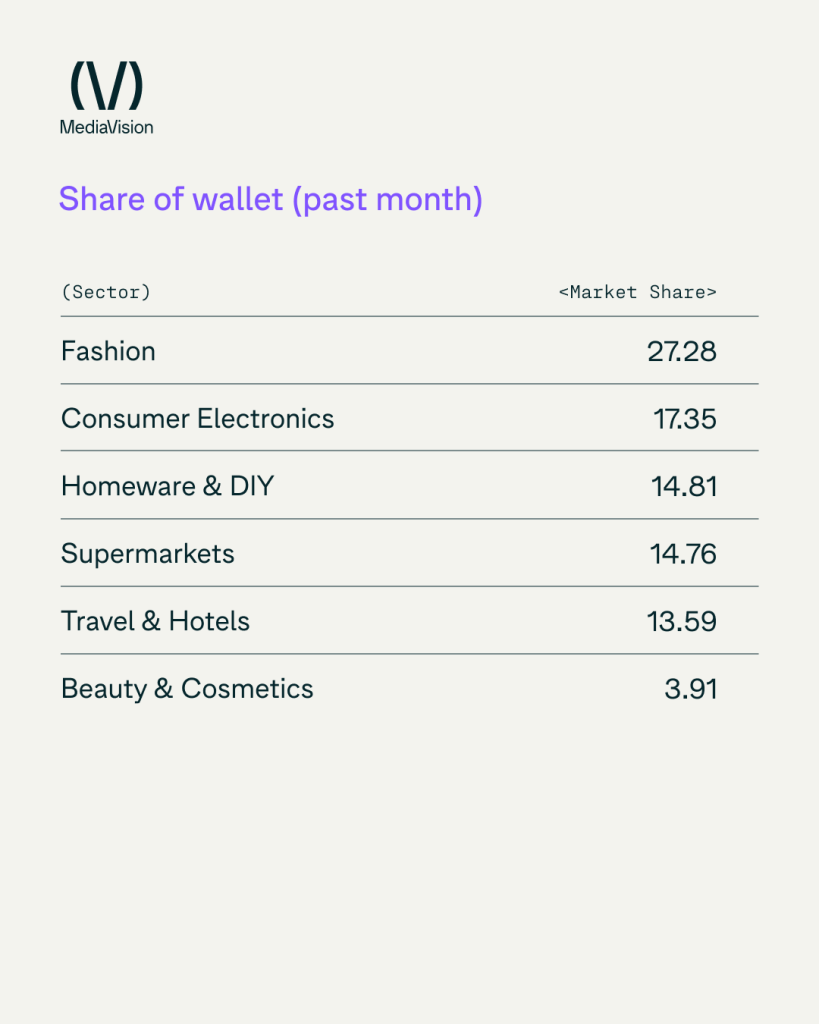

Where spending is currently concentrated

Share of Wallet data across major sectors shows how UK consumers are prioritising their spending. Fashion continues to command the largest share at 27.28%, reinforcing its position as the dominant destination for discretionary income. Consumer electronics follows at 17.35%, reflecting ongoing demand for technology upgrades. Homeware and DIY account for 14.81%, closely matched by supermarkets at 14.76%, highlighting how spending on the home is competing directly with everyday essentials. Travel and hotels capture 13.59% as experiences remain a key consideration, while beauty and cosmetics sit at 3.91%, indicating a more selective and considered approach to non-essential personal care purchases.

This context matters. Slower growth in your category may reflect wider competition for spend rather than weakness in your offer.

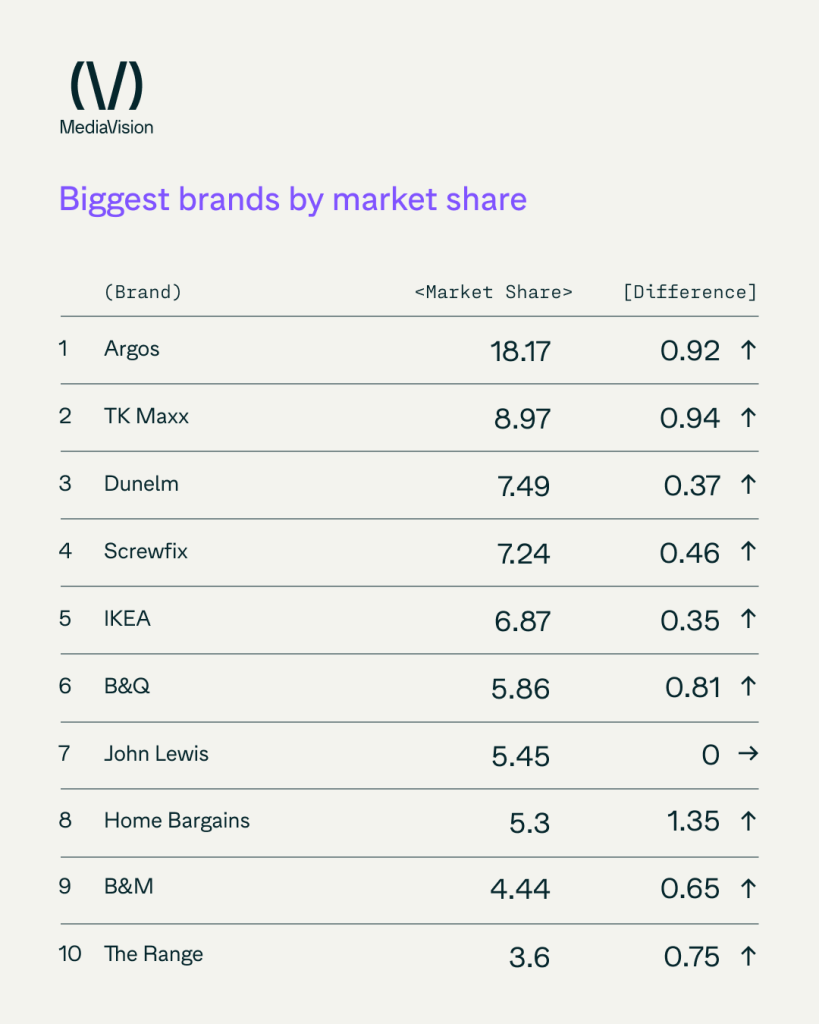

What the biggest brands reveal

Argos remains the market leader with an 18.17% share, driven by convenience and range. However, even this position is not static. The gap between established brands and fast-moving value retailers shifts weekly. TK Maxx and Dunelm follow with 8.97% and 7.49% respectively. Both have aligned strongly with consumer priorities, either through perceived value or specialist home expertise.

Tracking these movements at speed allows you to see where your share is under pressure and where opportunity is emerging.

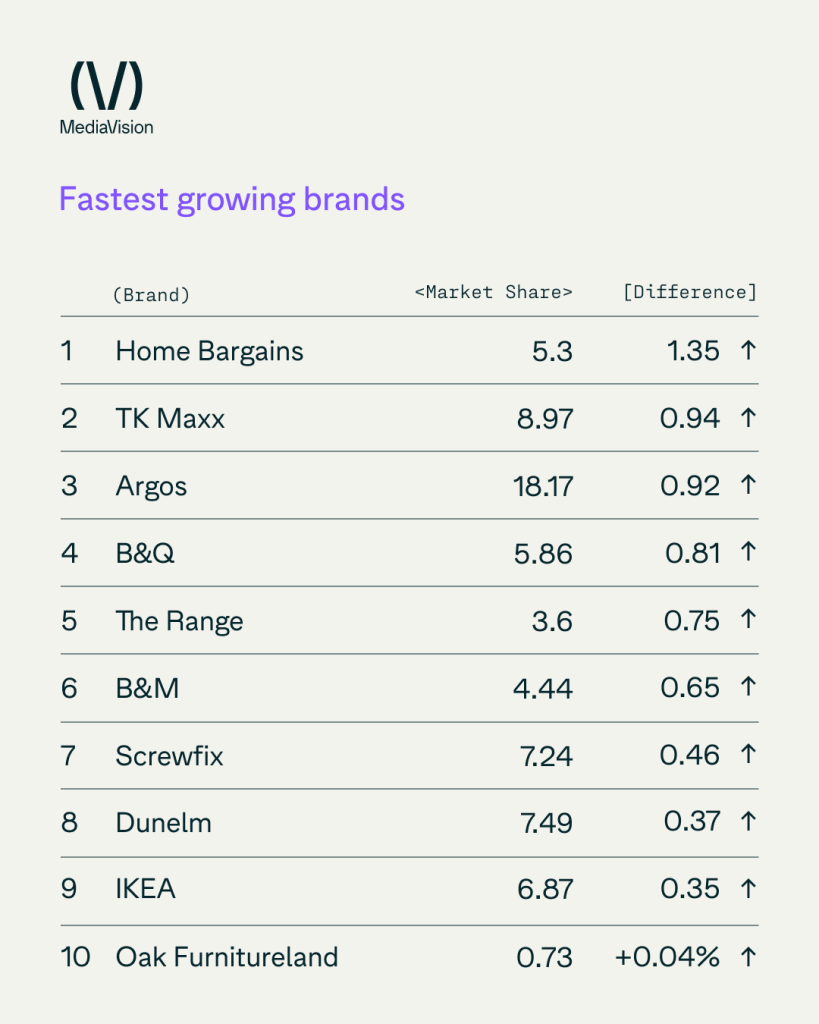

The rise of value and focused growth

The fastest-growing brands tell a consistent story. Value retailers are gaining ground. Home Bargains has seen the largest positive shift, growing its share by 1.35 points. This reflects a consumer who is prioritising price and efficiency. TK Maxx and Argos continue to grow as well, showing that scale combined with value still wins. Smaller brands can also find momentum. Oak Furnitureland, despite a modest overall share, shows growth driven by targeted interest in big-ticket refreshes.

When you can see which categories drive growth every seven days, you can spend with far greater precision across paid and organic channels.

What consumers are actually searching for

Product-level demand provides a clear roadmap. Searches are dominated by comfort and home improvement:

- Mattress toppers are up over 50% as shoppers seek affordable sleep upgrades

- Sofas and corner sofas continue to attract high volumes

- Mirrors and bedside tables reflect low-effort home refreshes

- Hammocks point to lifestyle and indoor decor trends

If you are not visible for these searches, you are missing buyers who are already ready to purchase.

The CMO perspective: capture intent, not just attention

The message from the data is clear. Consumers are telling you what they need, but they are not asking for you by name.

When product search grows at 150 times the rate of brand search, strategy has to shift from brand-building to intent-capturing. Waiting for monthly reports means reacting too late, while faster competitors move first.

Metis is not just a tool. It enables you to move at the speed of the consumer and reduce risk in your marketing decisions. The most successful retailers will not be those with the biggest logos, but those present the moment a customer searches for a specific solution.

Now is the time to double down on non-brand SEO and GEO. High-intent traffic remains incredibly valuable. If your products genuinely solve a problem, search engines and AI models will surface you, but only if you give them the right signals.

Do not let your customers ghost your brand simply because you were looking in the wrong place. If you want to understand where demand is really shifting and how to capture it before your competitors do, contact us today and start turning real-time consumer intent into measurable growth.