UK Homeware Market Insights: Preparing for Q4 2025

As we head into the final quarter of 2025, both the season and consumer behaviour are undergoing a transformation. Shorter days, colder weather, and the anticipation of the festive period are shaping how households across the UK prepare their homes. Against this backdrop, our latest Metis data highlights several pivotal shifts in the homeware market—shifts that bring both challenges and opportunities for brands and retailers alike.

One of the most striking developments is the steady decline in brand loyalty. Brand-led searches are down by 5.94% year-on-year, suggesting that shoppers are less inclined to stick with familiar household names. At first glance, this could be seen as a warning sign for established retailers. However, it also indicates that consumers are becoming increasingly needs-driven, placing their focus on finding the right product rather than automatically defaulting to a brand they know. Supporting this, non-brand, product-specific searches have risen by 7.83%, creating fertile ground for retailers who can position themselves effectively to capture these more targeted, high-intent queries.

A Market in Motion

The homeware sector has always been diverse, spanning everything from furniture and storage to décor and seasonal items. Yet, as our data shows, consumer priorities are shifting. With more time spent indoors during the colder months, and preparations underway for family gatherings, the emphasis is now on products that combine comfort, practicality, and design appeal.

This behavioural shift is reflected in the surge of searches for categories such as sofa beds and bedside tables—functional items that help households make better use of their living spaces during the busy festive season. It’s a reminder that the heart of the market lies in meeting specific consumer needs at the right moment.

The UK’s Biggest Homeware Brands by Search (August 2025)

Despite the move towards product-led shopping, the influence of big-name retailers remains significant. Based on Metis search share data, several brands continue to dominate the landscape.

- Argos maintains its commanding lead with a whopping 13.7% share of brand search, cementing its reputation as a go-to for convenience and variety.

- Dunelm continues to thrive as a category specialist, appealing strongly to consumers who want breadth and depth in homeware.

- John Lewis & Partners leverages its heritage, service reputation, and quality credentials to remain highly competitive.

- B&Q brings the home improvement perspective, integrating functional products with the DIY market.

- TK Maxx capitalises on its off-price model, appealing to bargain-hunters who want branded homeware at reduced prices, but has dropped one in rank position, swapping with Primark’s 4th position in July.

The presence of such a diverse mix of players underscores the breadth of the market. Yet even these heavyweights are not immune to the growing emphasis on product discovery. Their challenge lies in striking the right balance between leveraging brand equity and responding nimbly to product-led search behaviours.

The Fastest-Growing Brands in the Market

While the leaders hold significant share, the growth trajectory tells an equally compelling story. According to Metis data, several brands are gaining momentum:

- IKEA and John Lewis & Partners are achieving strong gains, suggesting that recent campaigns, product innovations, or successful seasonal positioning are resonating. Their ability to combine trust with relevance is helping them stay front of mind.

- The Range and Home Bargains are seeing significant growth, demonstrating that value-driven retail remains critical in a cost-conscious climate. As shoppers face continued pressures on household budgets, the appeal of affordable yet stylish homeware options has never been stronger.

Together, these trends suggest that consumers are not merely flocking to the lowest price point, but are weighing value, quality, and practicality in their decision-making.

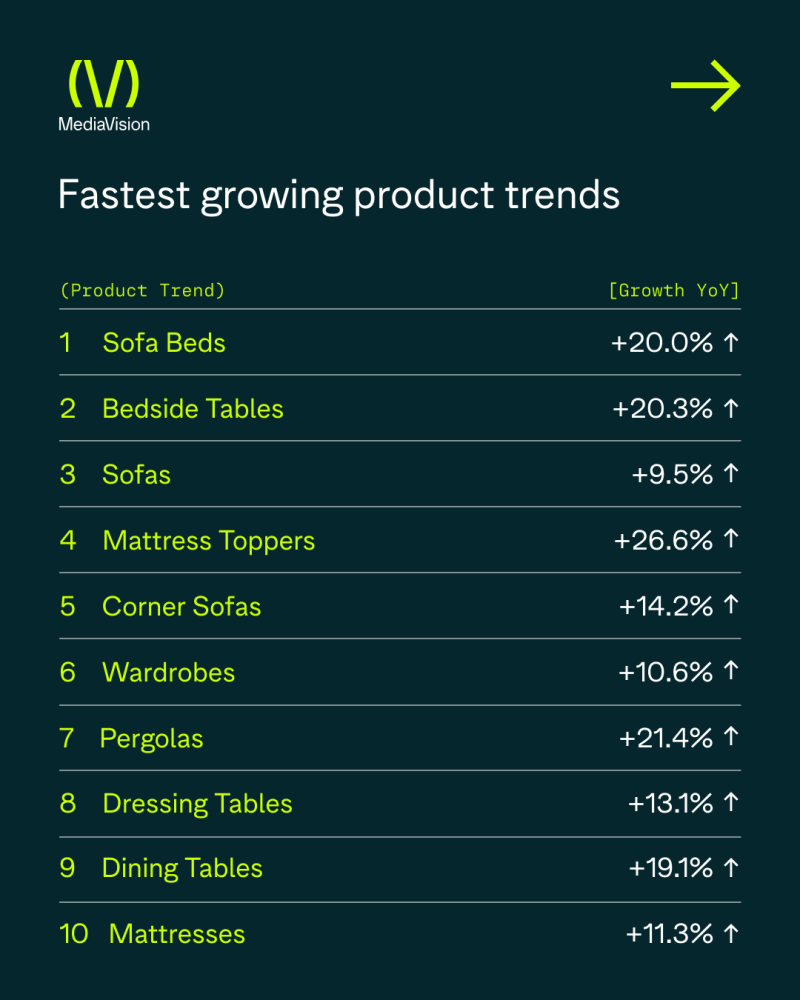

The Fastest-Growing Product Trends

The clearest signal from this quarter’s data is the rise of product-led searches. Consumers are heading online with specific items in mind, and the categories experiencing the sharpest growth reflect the dual priorities of comfort and utility.

Highlights include:

- Sofa beds – With homes doubling up as spaces for entertaining and accommodating guests, multifunctional furniture is in high demand.

- Bedside tables – A reflection of the trend towards practical storage and thoughtful design touches, particularly as people invest more in bedroom spaces.

- Festive décor items – Seasonal products are seeing a predictable lift as households prepare for celebrations, but with a growing preference for sustainable and reusable options.

These search trends reinforce the point that functionality is driving demand. Whether it’s maximising space, creating comfort, or achieving a festive atmosphere, consumers are focused on tangible outcomes rather than brand allegiance.

Key Takeaways for CMOs and Retail Leaders

The data paints a clear picture: the UK homeware market is shifting firmly towards product-led search behaviour. While brand equity remains important, the opportunities for growth increasingly lie in capturing the attention of needs-driven consumers.

For CMOs and marketing leaders, three priorities stand out:

- Optimise for Non-Brand Search

Focus on long-tail, product-specific queries such as “sofa beds” and “bedside tables”. These carry high purchase intent and are less competitive than broad brand searches, giving agile retailers the chance to win traffic and conversions. - Balance Brand and Product Strategies

Established players must use their brand strength to instil confidence while ensuring they are discoverable at the product level. Retailers who neglect product-specific optimisation risk losing share to more nimble competitors. - Leverage Seasonal Timing

The run-up to Christmas and the New Year is a critical period. By aligning campaigns and content strategies with the seasonal context—comfort, hosting, and affordability—brands can position themselves where consumer intent is highest.

Acting on Insight

The data from the latest Metis report makes it clear that no brand, however established, can afford to stand still. While giants like Argos and IKEA continue to command attention, the fastest gains are being made by those who are able to anticipate shifts in consumer behaviour and respond proactively.

This is where Metis proves invaluable. By surfacing these shifts before they reach peak, brands can act up to four times faster than the competition, gaining a decisive edge in a market where speed and agility matter as much as scale.

As the festive season approaches, the opportunity is clear: consumers are searching with intent, and they are searching now. The question for brands is whether they are positioned to be found.

Get in touch with Media Vision to see how our insight-driven strategies can help you capture demand and outperform the market this quarter.