Metis Data Reveals Shifting Search Dynamics in the UK Homeware and DIY Sector

The latest Metis data reveals a changing search landscape in the UK homeware and DIY market. While the sector remains competitive, underlying search behaviour indicates that consumers are moving away from brand-led engagement toward product-driven discovery.

This shift carries major implications for retailers and marketers ahead of the peak winter trading season. Understanding how consumers are searching — and where they are investing their intent — will be key to capturing market share in an increasingly dynamic environment.

Brand Search Declines as Discovery Rises

Brand search has fallen 6.9% year-on-year, signalling a softening in brand affinity. Consumers are no longer starting their journey with a particular retailer in mind; instead, they are exploring options, comparing products, and seeking value before committing.

In contrast, non-brand, product-led search is up 6.54%. This suggests that the consumer journey is becoming more open-ended, influenced by inspiration, peer recommendations, and competitive pricing rather than legacy loyalty. For marketers, it highlights a growing need for strategies that prioritise visibility at the discovery stage, where brand preference has yet to form.

This behavioural shift mirrors broader economic sentiment. With cost-of-living pressures persisting, shoppers are approaching purchases more pragmatically, favouring research and evaluation over impulse and habit. The brands that capture attention early in this cycle — with optimised product visibility and relevant content — are the ones converting intent into sales.

Comfort, Functionality and Seasonal Preparation Drive Demand

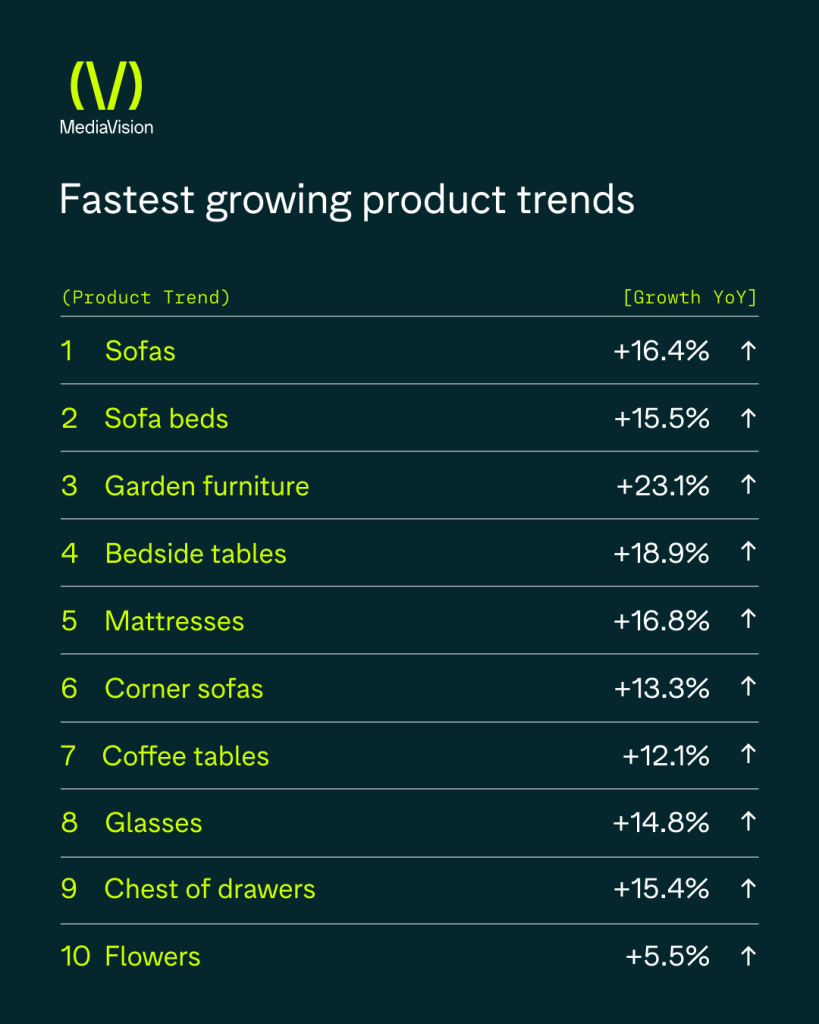

As temperatures drop and the festive season approaches, search behaviour reflects a strong focus on comfort and home improvement. Product categories showing the fastest growth include:

- Bedside tables (+19%) and chests of drawers (+15%)

- Sofas (+16%) and sofa beds (+15%)

- Corner sofas (+13%) and coffee tables (+12%)

- Mattresses (+17%)

- Garden furniture (+23%)

The continued interest in garden furniture, even as winter sets in, suggests early planning for spring and opportunistic buying during end-of-season promotions. Overall, these patterns indicate that consumers are investing in their living spaces with an emphasis on functionality, warmth, and value.

From a marketing perspective, this creates a window of opportunity. The rise in product-led search means content, structure, and keyword optimisation must reflect how people are searching for items that fit specific needs — whether for comfort, practicality, or gifting.

The Market Leaders: Visibility and Multichannel Strength

Argos continues to lead the sector in search visibility, holding an 18.9% share. Its success highlights the ongoing value of a multichannel presence, where convenience and accessibility reinforce digital dominance.

Other top performers include TK Maxx, B&Q, Dunelm, IKEA, and John Lewis, all maintaining strong visibility through diverse product portfolios and consistent investment in digital optimisation.

Within this group, IKEA (+0.98%) and John Lewis (+0.8%) stand out for their growth, both capitalising on data-led marketing and agile merchandising. Home Bargains (+0.76%) has also strengthened its position, driven by value-based offers and increasing brand awareness among cost-conscious audiences.

These brands are not merely maintaining share; they are actively shaping the sector’s competitive dynamics. Their ability to align product, price, and visibility continues to set consumer expectations for the category.

Fastest-Growing Brands: Agility in Action

Growth momentum is strongest among brands that have adapted quickly to the rise of discovery-led search.

- IKEA, John Lewis, Home Bargains, and Argos all show clear gains, reflecting the importance of aligning inventory, messaging, and SEO with evolving intent signals.

- The Range, B&Q, Dunelm, and B&M are also performing well, each leveraging agility to strengthen their position in a market increasingly driven by online exploration.

Their progress illustrates a clear truth: in a search-led economy, visibility and adaptability are inseparable. The brands that act fast on emerging demand patterns are the ones capturing incremental growth.

Implications for CMOs and Digital Strategists

For marketing leaders, the data underlines a decisive shift in the relationship between brand and consumer. The pathway to purchase is no longer linear or loyalty-led; it is intent-driven, fragmented, and shaped by real-time discovery.

Three implications stand out for CMOs planning Q4 strategies:

- Search visibility must reflect intent, not just awareness.

Optimisation should prioritise product categories where consumers are actively seeking solutions — particularly those linked to comfort, value, and seasonal relevance. Generic brand activity is losing impact; performance is being driven by precision. - Organic visibility is an essential hedge against paid media inflation.

Paid search continues to grow more competitive and expensive, especially in high-intent categories. A well-structured SEO and content strategy reduces cost per acquisition and supports long-term profitability by ensuring that visibility is earned as well as bought. - Data agility is a key differentiator.

Brands that monitor search data closely can pivot faster, adjusting product promotion and content strategy to meet live consumer demand. In a market where trends evolve weekly, this responsiveness directly translates into revenue resilience.

These insights reinforce the value of a unified search strategy that integrates organic, paid, and content efforts around shared intelligence. Data-driven alignment ensures that every part of the marketing mix contributes to visibility, engagement, and conversion.

The Outlook for the Homeware and DIY Sector

The near-term outlook for the UK homeware and DIY sector remains cautiously positive. While consumer confidence is subdued, intent remains strong around practical and comfort-led purchases. Retailers who align with these needs — and communicate them effectively through search — will continue to see growth.

Competitive differentiation will depend increasingly on visibility at the product level, where decisions are made. Brands that invest in structured data, optimised content, and technical SEO will not only capture traffic but also influence perception at the discovery stage.

As the festive season approaches, the brands winning in search will be those that combine creative storytelling with precise, data-informed optimisation. Visibility will no longer be a by-product of brand strength — it will be a core performance metric in its own right.

Positioning for Success

The Metis data makes one thing clear: consumer behaviour is moving towards discovery-led decision-making. The brands that thrive in this environment will be those that recognise the changing role of search — from a transactional tool to a strategic insight engine.

For CMOs, now is the time to ensure that your SEO, content, and paid media strategies are aligned to how consumers are truly searching. Acting on these insights not only captures seasonal intent but also builds long-term equity and competitive advantage.

Get in touch with MediaVision to learn how our Metis data and organic growth strategies can help you identify emerging trends, optimise visibility, and turn discovery into performance.