The high-intent beauty boom: why brand search is losing to specific needs

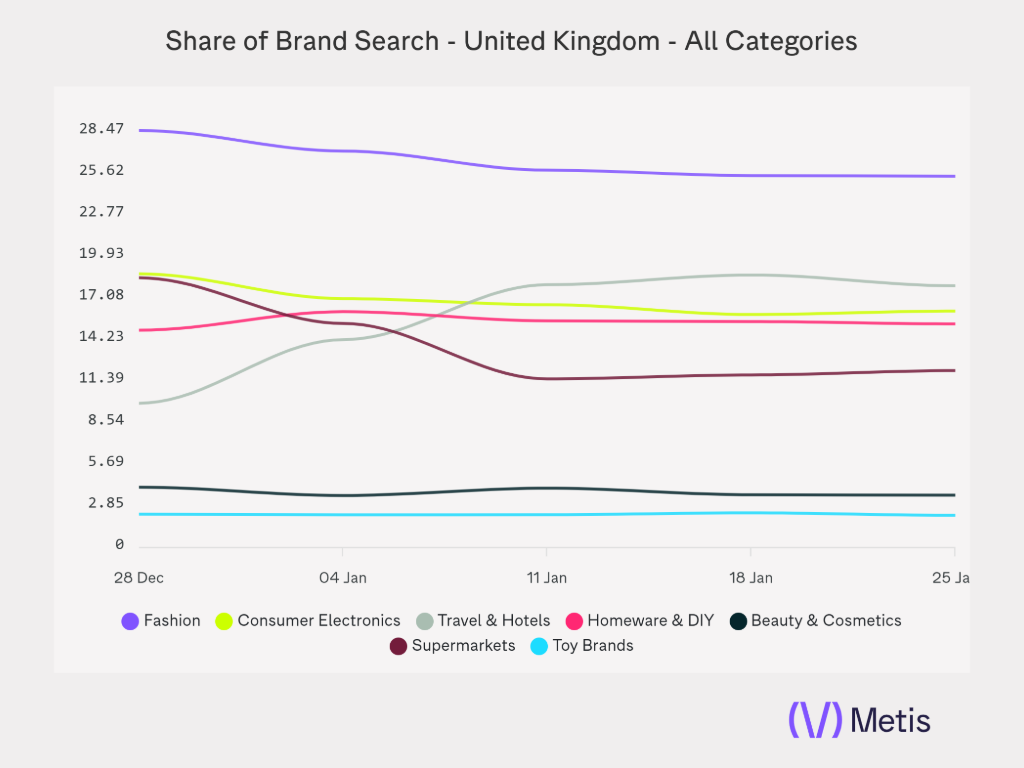

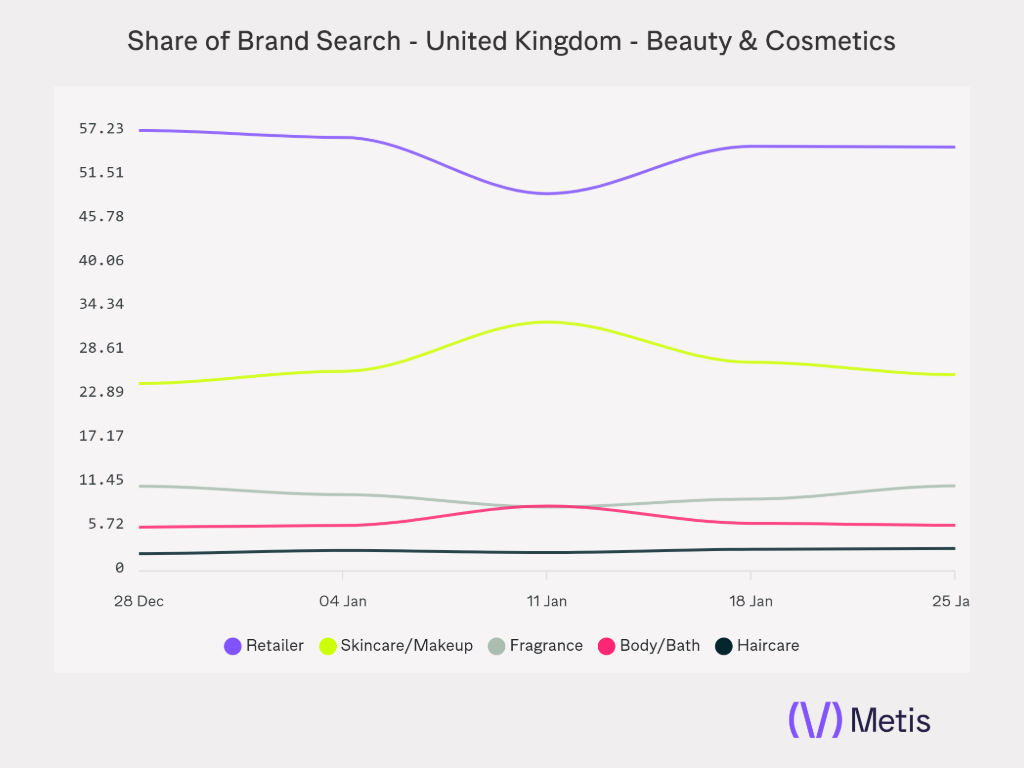

The UK beauty sector is entering a new phase of growth, one defined less by brand loyalty and more by sharply defined consumer intent. According to the latest Metis data, product specific beauty searches are up 15% year on year, significantly outperforming the wider retail market. By comparison, brand specific search is growing at a far more modest 2.53%.

This gap tells a clear story. Consumers are increasingly searching for the solution before the supplier. Rather than starting with a familiar brand name, they are beginning with a problem, an ingredient, or a desired outcome. This shift towards discovery led shopping has major implications for how beauty brands approach SEO, content, and budget allocation in 2026.

Download our latest Beauty Report

Discovery first, brand second

As we move through the first quarter of the year, search activity is heavily concentrated around bio intelligent skincare and high tech wellness. The rise of what is being described as “Metabolic Beauty” reflects the growing overlap between health, longevity, and cosmetics. Consumers are no longer satisfied with vague promises. They are actively seeking products that claim measurable physiological results.

This is driving growth in searches tied to specific ingredients, technologies, and use cases. For CMOs, this means the opportunity to capture non brand traffic has never been greater. However, it also means that generic skincare landing pages are no longer enough. Visibility now depends on precise, mission led content that directly answers what the consumer is asking for in that moment.

Metis evaluates these shifts on a weekly basis, allowing partners to see which ingredient or tech led trends are accelerating up to four times faster than traditional monthly reporting would reveal. That speed to insight is critical. In a market that moves this quickly, the difference between leading a trend and chasing it is often measured in days, not quarters.

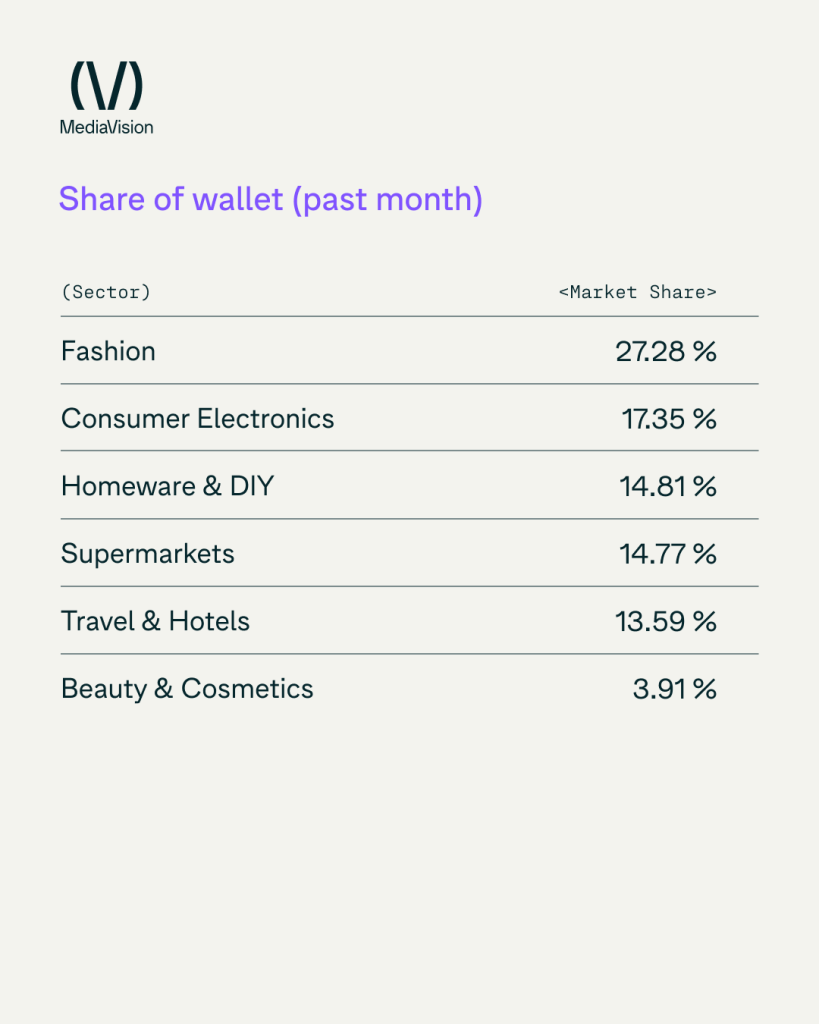

Share of Wallet and the real competition

Alongside search behaviour, discretionary spend is becoming increasingly contested. This is why Metis has introduced Share of Wallet, a first of its kind feature that groups major UK retail sectors to show where consumers are actually choosing to spend.

In practical terms, your biggest competitor may not be another beauty retailer. It could just as easily be a flight deal, a fashion drop, or a lifestyle subscription that tempts the consumer to reallocate their budget. Viewing performance through this macro lens allows brands to understand the Lipstick Effect in real time.

Metis data shows that even when overall retail spend tightens, beauty and cosmetics often retain a resilient share of wallet. Beauty continues to function as an accessible luxury for UK consumers, holding its ground against sectors like fashion and travel. This insight gives CMOs the evidence they need to allocate budgets more intelligently rather than relying on instinct or outdated benchmarks.

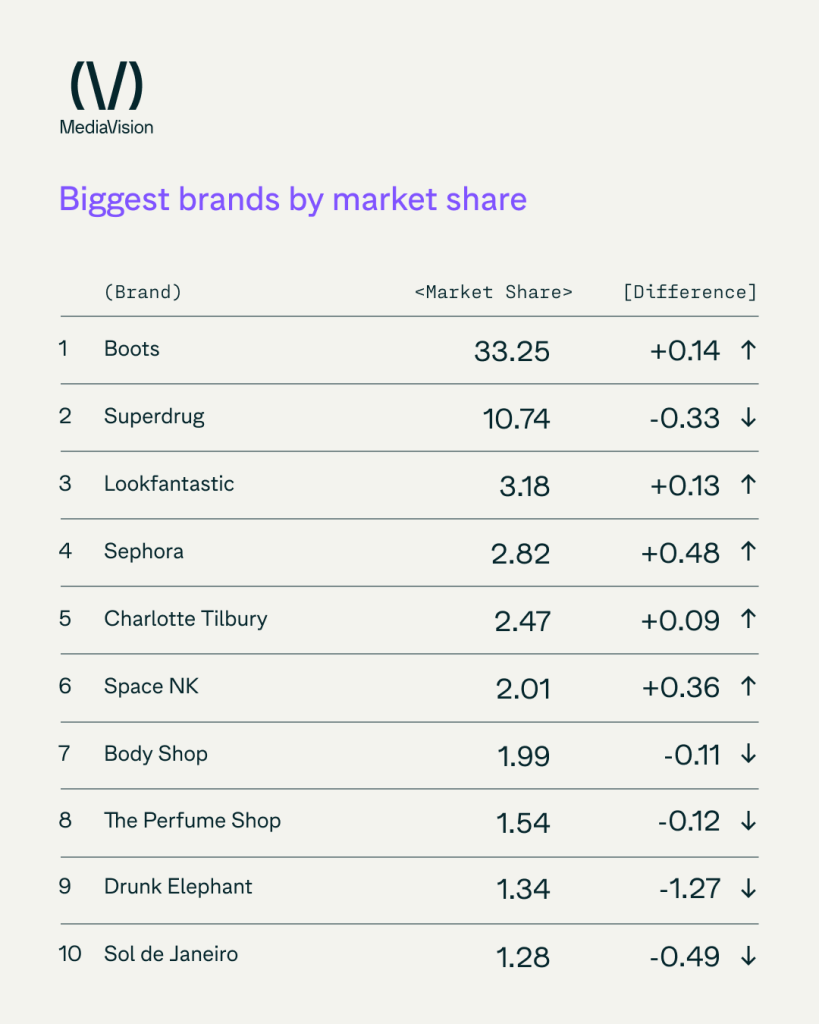

The industry titans and shifting market share

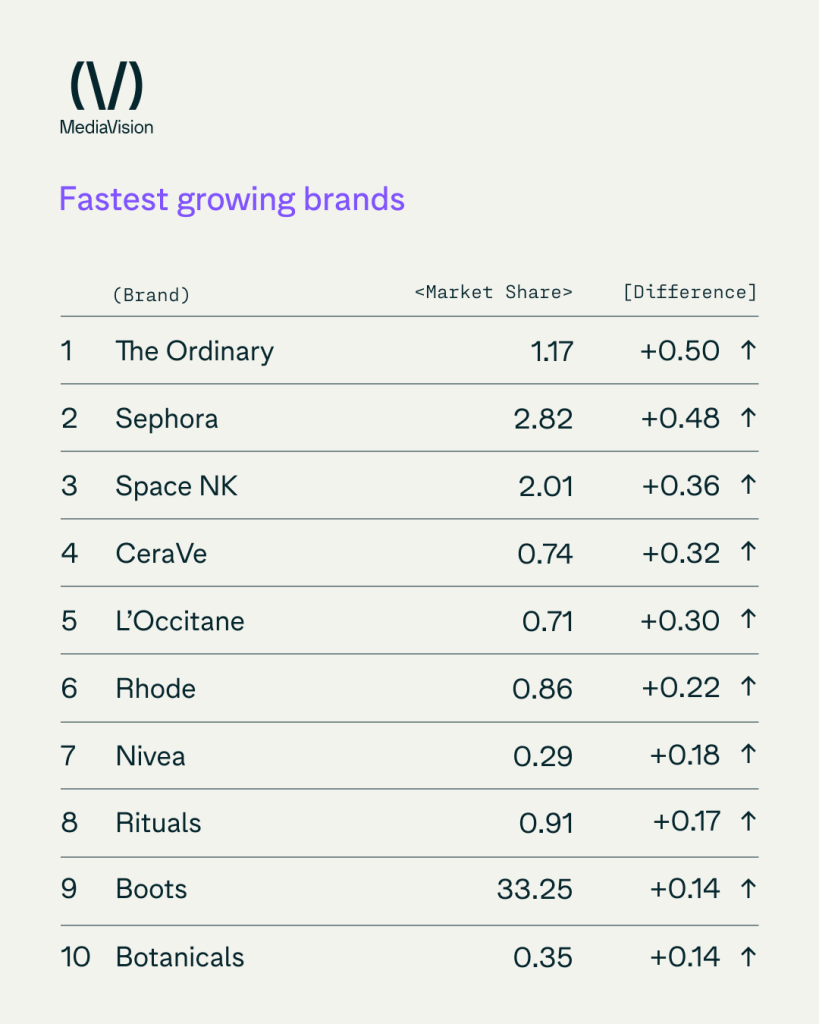

At a retailer level, Boots UK remains the undisputed titan of the beauty landscape, commanding a 33% market share. Recent initiatives such as their collaboration with Anya Hindmarch and the ongoing strength of the Boots Ignite data engine have helped them maintain slight positive growth of 0.14.

Superdrug follows with a 11% share but has experienced a contraction of 0.33. Much of this pressure can be attributed to the aggressive expansion of Sephora across both physical and digital channels in the UK.

Sephora is the standout challenger, recording a 0.48 increase in market share. Their ability to attract the masstige shopper and rapidly bring viral US brands to the UK market has made them a serious threat to traditional department stores. Weekly tracking through Metis reveals that these gains are often coming directly at the expense of brands that fail to respond quickly to changing demand signals.

Velocity matters: brands and products on the rise

Looking at brand velocity, The Ordinary and Sephora are leading current growth trends. The Ordinary has recorded a 0.50 increase in share, reinforcing the rise of the ingredient savvy consumer who prioritises clinical efficacy and transparent pricing. Space NK and CeraVe are also showing strong momentum, demonstrating that whether positioned as luxury or mass market, expert backed credibility is the key growth driver for 2026.

Niche and celebrity led brands are also making their presence felt. Rhode skin, up 0.22, highlights the importance of cultural relevance and the speed at which brands can move from virality to shelf.

Metis enables brands to measure the impact of a single social media campaign on search demand within seven days, rather than waiting for quarterly sales data.

On the product side, early 2026 search data is dominated by beauty tech and protective skincare:

- LED face mask searches are up 109.94 percent year on year, signalling the mainstream adoption of salon grade technology at home

- Searches for “best sunscreen for face” have surged by 291.02 percent, reflecting a more educated consumer focused on daily protection and longevity

- Hydrocolloid and under eye patches are seeing double digit growth, driven by demand for fast, visible results

These are mission led purchases. If your site is not ranking for these active terms, you are effectively handing thousands of high converting clicks to more agile competitors every week.

The CMO perspective: own the mission

If your 2026 strategy still leans heavily on general brand awareness, you are playing from behind. The consumer journey has shifted from “who are you?” to “what can you do for me?”. With product search growing at six times the rate of brand search, appearing on the results page for terms like best sunscreen or LED face mask is often more valuable than traditional brand exposure.

The beauty market now moves at the speed of a TikTok algorithm, while many reporting systems still operate like legacy spreadsheets. Metis closes that gap by delivering insights four times faster, allowing CMOs to pivot SEO, PR, and inventory strategies while demand is still rising.

Now is the moment to audit your non brand authority. Are you recognised as the expert for the trends that are actually growing, or are you still over indexed in categories that are flatlining?

The most successful CMOs this year will be those who use real time demand signals to bridge the gap between what they sell and what consumers are actively searching for right now.

Want more insights, faster?

Talk to us about how Media Vision can help you unlock beauty and fashion insights like these four times faster with Metis, our award winning SEO software. Get in touch.