UK Electronics Search Trends: Smart Tech, Seasonal Shifts & the Brands Winning on Agility

The latest Metis data from MediaVision shows the UK electronics sector holding steady, with brand search growth almost flat at +0.58% year-on-year, while non-brand, product-led searches are up +2.59%.

This tells a clear story: shoppers are still turning to familiar names for big-ticket items, but they’re increasingly beginning their journey with what they want, rather than who they’ll buy it from.

With Christmas shopping already ramping up, there’s strong early momentum in gifting categories such as:

- Coffee machines (+30%)

- Firesticks (+62%)

- Ring Doorbells (+18%)

Meanwhile, colder weather is pushing demand for smart home products like Hive and energy-efficient appliances, as consumers look for comfort and control heading into winter.

The takeaway is simple — consumers are leaning into value, practicality, and convenience. Brands that align early with this behaviour in search will be best positioned to capture spend through the crucial festive period.

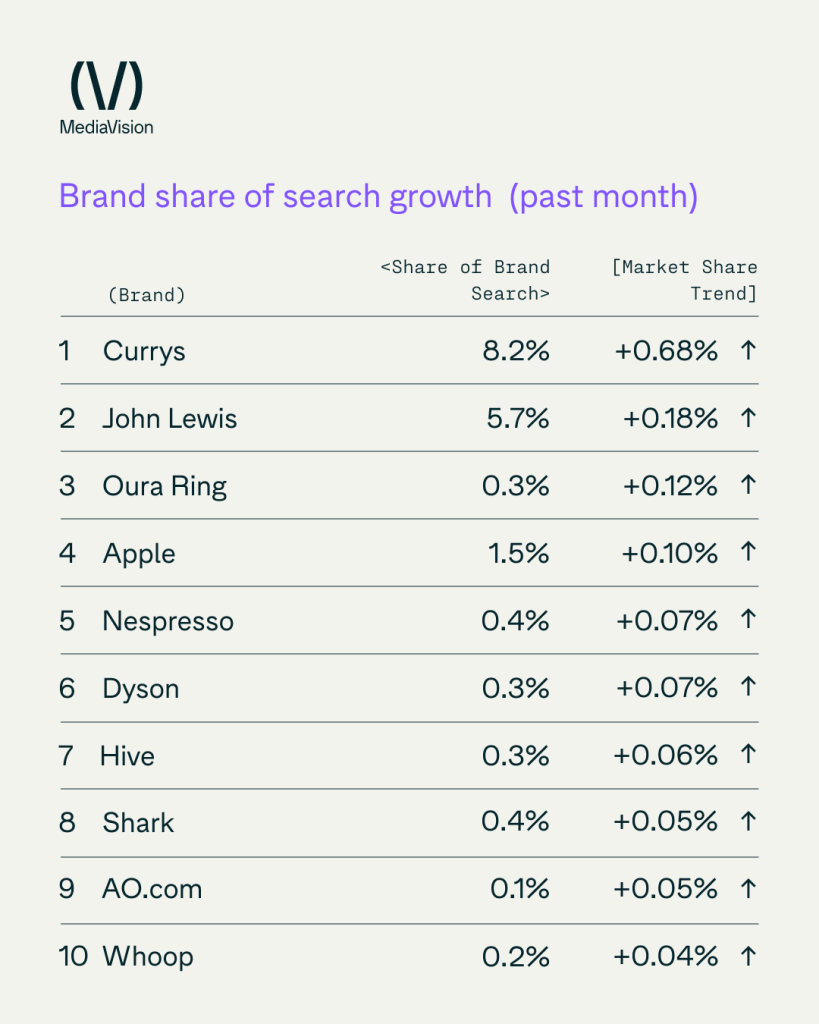

The Biggest Brands

In terms of search visibility, the UK electronics market remains dominated by the major retail players. Amazon, Argos, and Currys continue to lead the way — but the dynamics are shifting.

- Amazon holds the top spot with 35.1% market share, though it’s showing a slight year-on-year softness (–1.68%).

- Argos follows with 15.5%, dipping marginally (–0.25%).

- Currys is the standout this month, climbing +0.68%, driven by competitive pricing and strong product visibility.

Elsewhere, John Lewis (+0.18%) and Apple (+0.10%) continue to consolidate their presence, while Nespresso and Shark are showing consistent gains in smaller, fast-moving segments such as coffee tech and household appliances.

The data underlines that while established giants dominate, smaller niche brands are gaining traction by meeting evolving consumer needs faster — from home energy management to lifestyle-enhancing gadgets.

Fastest Growing Brands

This month’s movers reflect how rapidly consumer attention can pivot across product ecosystems.

Currys continues its upward trajectory (+0.68%), while John Lewis maintains steady growth (+0.18%) thanks to its trusted positioning and curated brand partnerships.

Emerging players are also carving out valuable search real estate:

- Oura Ring (+0.12%) and Whoop (+0.04%) highlight growing consumer appetite for wearable tech and wellness integration.

- Dyson (+0.07%) and Shark (+0.05%) are capitalising on seasonal household demand, especially in cleaning and home-care categories.

- Hive (+0.06%) stands out as a clear smart-home success story, perfectly aligned with rising interest in energy efficiency and comfort through the colder months.

These shifts demonstrate the growing diversity in consumer electronics — where lifestyle, health, and sustainability are intersecting with traditional tech buying patterns.

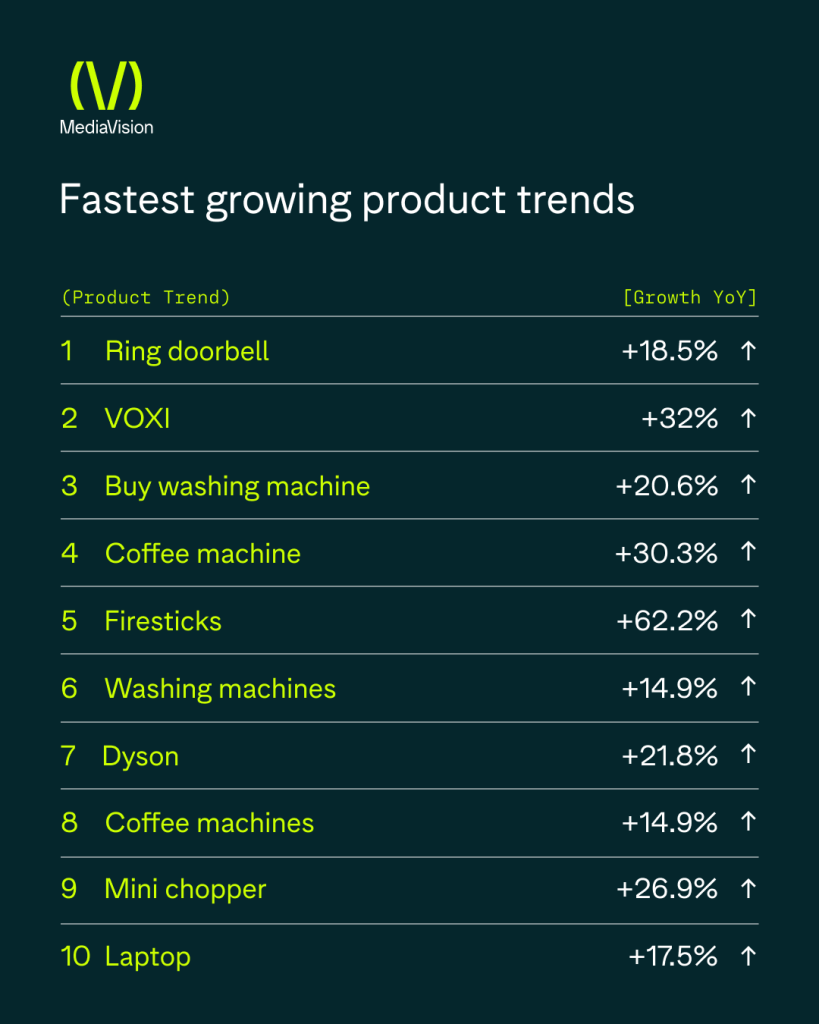

Fastest Growing Product Trends

At the product level, the search data reveals both seasonal buying intent and tech-driven convenience shaping the market.

Leading the charge are Firesticks (+62%) and coffee machines (+30%) — clear indicators that consumers are in gifting mode, prioritising comfort, entertainment, and home experiences.

Smart home and connected living products continue to rise, with Ring Doorbells (+18.5%) and Hive devices gaining further traction as home automation becomes mainstream.

Meanwhile, washing machines (+20%) and laptops (+17.5%) remain core essentials, as consumers invest in upgrades and efficiency ahead of the new year.

These patterns reinforce how functional tech is becoming an emotional purchase category — shoppers are investing in products that enhance both comfort and lifestyle.

Key Takeaways

The UK electronics market is stable yet evolving, with non-brand discovery and category-led search behaviour continuing to rise. This shift highlights a critical need for brands to appear earlier in the intent journey — before consumers decide where to buy.

Key insights include:

- The market remains steady, but non-brand discovery continues to grow.

- Currys and John Lewis stand out as examples of brands that are adapting quickly to shifting demand.

- Smart home, small appliances, and connected devices are defining the current opportunity space.

- With paid search costs continuing to climb, a strong SEO strategy that captures emerging demand early is crucial to protecting margins and driving efficient growth.

At MediaVision, our Metis platform surfaces these opportunities four times faster than competitors — helping retail brands move from data to growth before others even see the shift.

Want to see how your brand compares?

Get in touch with MediaVision’s retail search experts to uncover the real-time trends shaping your category — and start converting insight into performance.