Search Unlocked: UK Electronics in Focus

The latest Metis data paints a mixed but revealing picture of the UK electronics sector. Brand search is down 2.09% year on year, while non-brand, product-led search has climbed 2.67% — signalling a notable shift in how consumers are shopping for tech.

You’re seeing the same story play out across multiple retail verticals: people are becoming less loyal to specific brands and more driven by what they want rather than where they’ll buy it. This growing emphasis on product discovery, comparison, and value has reshaped the digital landscape — particularly as the festive shopping season ramps up.

A Market Driven by Discovery

The data suggests that UK shoppers are entering the electronics market earlier and more deliberately this year. Searches are climbing in key gifting categories as people plan ahead and prioritise practical yet premium purchases.

Strong growth can be seen across:

- Coffee machines (+44%) – reflecting a renewed appetite for at-home indulgence and small luxuries.

- Smart televisions (+103%) – a standout surge as households prepare for a winter of streaming, gaming, and sports.

- Laptops (+18%) – steady demand ahead of Christmas, boosted by hybrid working and student needs.

- AirPods and iPhones – maintaining consistent momentum as evergreen favourites in the gifting space.

Meanwhile, we’re seeing trusted retailers like Currys and John Lewis post modest gains in visibility and engagement, while Amazon and Argos have softened slightly. That shift suggests consumers are browsing across multiple retailers before committing — comparing not just prices, but delivery options, warranties, and sustainability credentials too.

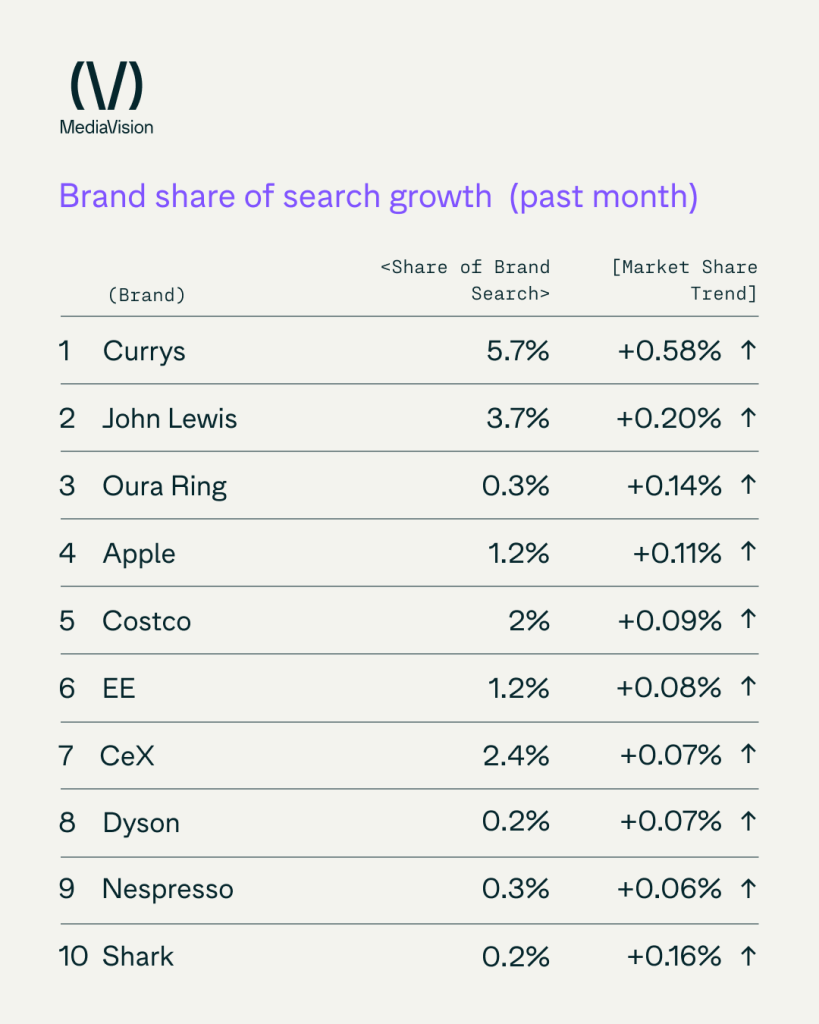

Spotlight on the Biggest Brands

The major names still dominate UK electronics search, but their performance reveals how consumer preferences are evolving.

- Amazon remains the category leader, commanding a 23.2% share of brand search, though down 1.62% YOY, showing signs of saturation and stiffer competition from multi-channel rivals.

- Argos holds 10% share but has also dipped slightly (-0.57%), as consumers increasingly use it as a reference point rather than a purchase destination.

- Currys stands out with a +0.58% gain, demonstrating the strength of combining omnichannel presence with content that supports decision-making on big-ticket items.

- John Lewis continues its upward climb (+0.20%), reaffirming the value of trust, quality, and aftercare.

- Apple (+0.11%) and Costco (+0.09%) show steady gains, highlighting strong ecosystems and value-driven positioning.

- EE and Vodafone remain stable, reflecting consistent interest in telecoms and device bundling.

The takeaway? Consumers still lean on established brands for reassurance — but the battleground has shifted to where and how they begin their search. Being visible at the product stage, not just the brand stage, has never been more important.

The Fastest-Growing Brands

Growth across the sector is being fuelled by a healthy mix of heritage brands and new-wave innovators that blend technology with lifestyle appeal.

- Currys continues to lead the charge (+0.58%) through diversified product strategies and clear online discovery paths.

- John Lewis maintains its strong performance (+0.20%), leveraging brand trust during key retail periods.

- Emerging and lifestyle-led brands are seeing real momentum, including Oura Ring (+0.14%), Dyson (+0.07%), Shark (+0.05%), and Nespresso (+0.06%) — all positioned at the intersection of innovation and self-care.

- Established players such as Apple, EE, and CeX continue to post incremental gains, reflecting diversified audiences and strong product ecosystems.

What’s driving these movements is clear: innovation, lifestyle integration, and customer experience. Brands that connect with both the emotional and practical sides of consumer tech ownership are gaining visibility and engagement.

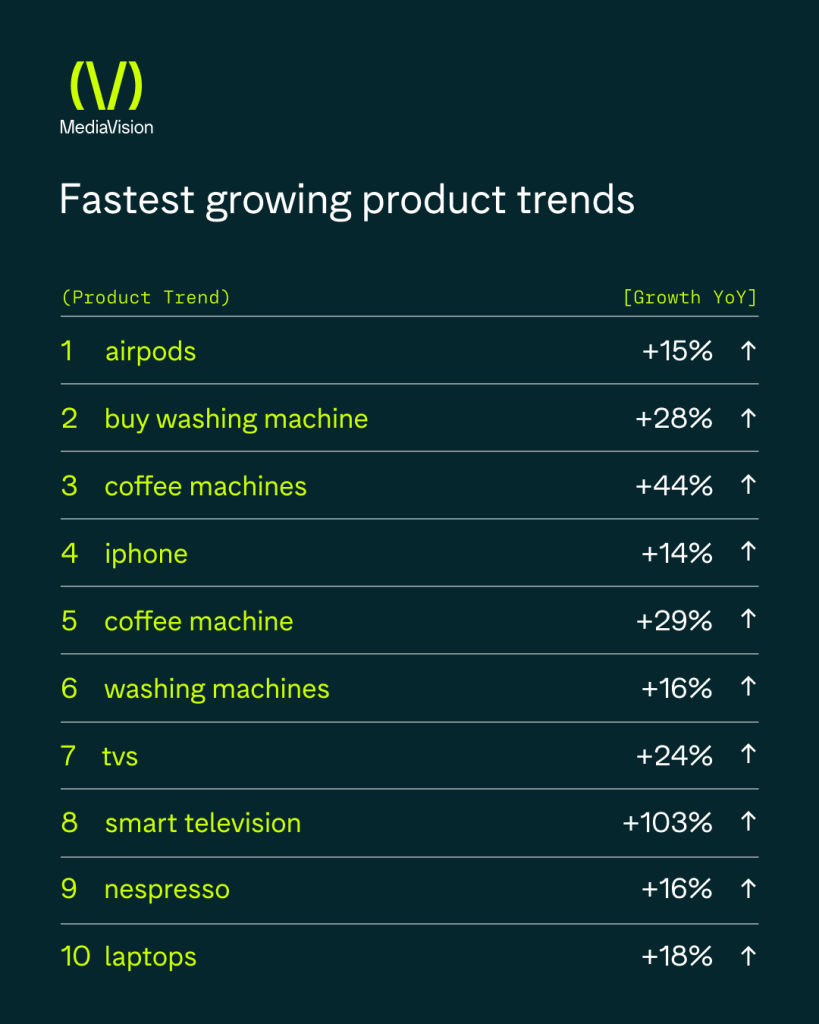

Fastest-Growing Product Trends

The latest search data reveals exactly where consumer interest is peaking — and what that means for marketers.

- Smart televisions (+103%) are the clear front-runner, driven by home entertainment upgrades and new product launches.

- Coffee machines (+44%) and Nespresso (+16%) continue to benefit from the at-home coffee culture that shows no sign of slowing.

- Washing machine (+28%) and washing machines (+16%) searches are climbing, reflecting household upgrades and energy efficiency awareness.

- Laptops (+18%) and iPhones (+14%) remain consistent performers, with tech gifting and hybrid work fuelling search activity.

- AirPods (+15%) continue to dominate in the premium audio space, combining portability, design, and brand desirability.

Collectively, these trends underline a dual mindset among UK shoppers — a balance between functionality and experience. Whether it’s upgrading essentials or indulging in the latest smart tech, consumers are spending thoughtfully and searching strategically.

Key Takeaways for CMOs

In a sector that moves as fast as electronics, timing and agility matter more than ever. Metis data highlights several actionable insights:

- Product-led discovery is rising: Non-brand search growth means SEO needs to focus on early intent — meeting consumers when they’re still exploring, not just ready to buy.

- Retailer resilience varies: With Amazon and Argos softening, brands like Currys, John Lewis, and Apple are winning by connecting product relevance with content visibility.

- Lifestyle tech dominates gifting: Smart TVs, coffee machines, and premium audio are setting the tone for a season defined by comfort, convenience, and experience.

- SEO agility is key: Consumer intent now swings between practical and aspirational. Success depends on how fast you can pivot your organic strategy to match those shifts.

The bottom line? The UK electronics market is evolving fast — and the brands that thrive will be those using data to anticipate, not just react. As paid search costs continue to climb, organic visibility grounded in real-time insight is becoming a defining competitive edge.

With Metis, you can see emerging search trends before they peak — and act four times faster than the competition.

Ready to uncover what’s driving your sector?

Get in touch and we’ll show you how to unlock your brand’s next growth opportunity through Metis insight.