Search Unlocked: Beauty Sector Search Soars Ahead of Christmas

If you’re working in the beauty sector, the run-up to Christmas is always a pivotal time. From gift sets and luxury staples to fast-moving trends on TikTok and Instagram, shoppers are actively searching for inspiration and ready to purchase. But how do you cut through the noise and ensure your brand gets found first?

That’s where Metis makes all the difference. By uncovering the latest shifts in consumer intent, you can see where demand is building, which products are set to define the season, and which brands are capturing attention in real time. And right now, the story is clear: beauty is booming.

Search Demand is Growing Stronger

Across the UK beauty sector, year-on-year growth is pointing in a positive direction. Brand searches are up 6.19%, and product-led, non-brand searches are up an even stronger 9.34%.

For you, that means opportunity. Consumers aren’t just typing in their favourite brands — they’re actively exploring new categories and specific product types. This shift tells you two important things:

- Beauty brands remain a trusted destination.

- Shoppers are broadening their research, increasingly influenced by product need, lifestyle, or gifting opportunities.

Take perfume, makeup bags, and nail polish. These categories are showing strong uplift in search, underlining their role as gifting staples. Meanwhile, product-specific searches such as gel nail polish and makeup mirrors are surging, signalling that consumers want more than a logo — they want the right product at the right price point.

Even niche areas like auburn hair dye and personalised makeup bags are trending upwards. That’s a reminder that consumers are open to discovery if you can meet them with the right content at the right moment.

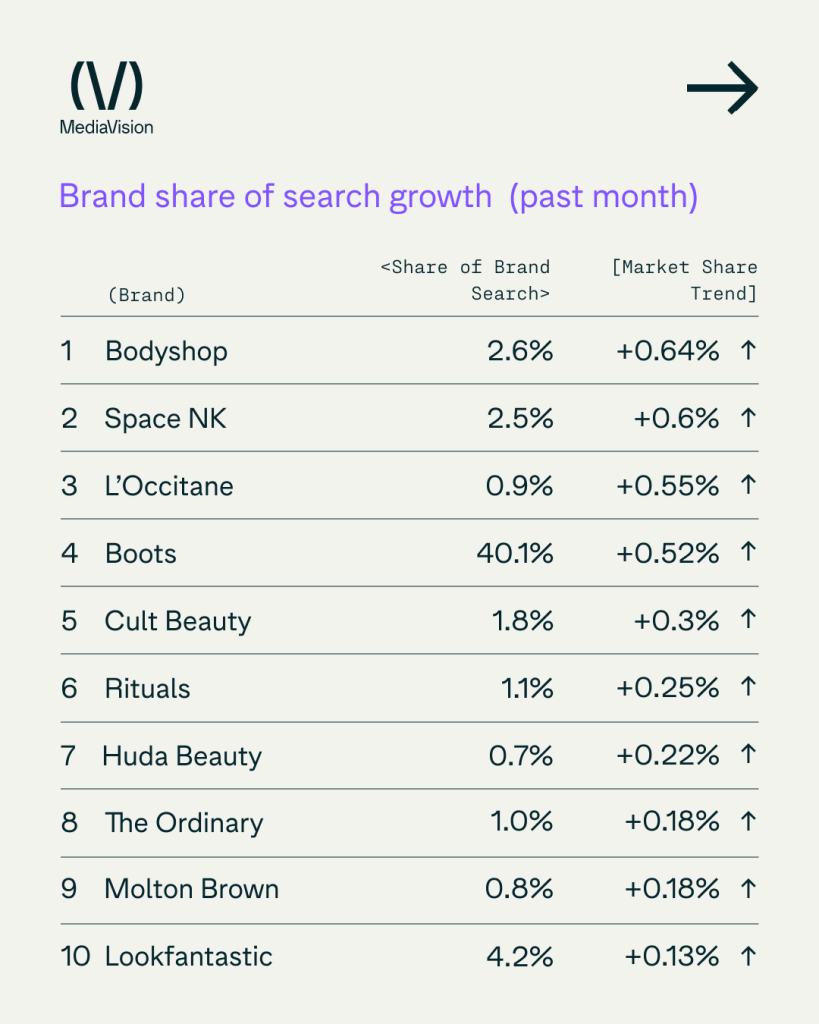

Who’s Winning the Brand Battle?

In the beauty market, brand equity is powerful — but it’s never static.

- At the top of the tree, Boots dominates with a 40.1% share of search, gaining a modest +0.52%.

- Superdrug holds second place with 11.4%, though it has slipped by -0.5%. This creates an interesting dynamic: Boots continues to grow from an already commanding position, while Superdrug is under pressure to hold its ground.

- Premium retailers like Lookfantastic, Sephora, and Charlotte Tilbury are stable, but the real movement comes from The Body Shop (+0.64%) and Space NK (+0.6%). Both are proving that strong seasonal positioning and giftable ranges can translate directly into search demand.

- Not every brand is enjoying momentum. Drunk Elephant, for example, has lost -1.7%, despite a strong performance earlier in the year.

For CMOs, this is a clear warning: consumer attention is fluid, and share can be lost as quickly as it is gained.

Fastest-Growing Brands You Should Watch

Digging deeper into the fastest risers tells you where the energy really lies.

- The Body Shop and Space NK lead the pack with strong gains, proof that heritage retailers with refreshed strategies can punch above their weight.

- L’Occitane (+0.55%) is benefiting from its reputation for giftable, luxury products.

- Digital-first challengers like Cult Beauty (+0.3%), Rituals (+0.25%), and Huda Beauty (+0.22%) are seizing niche audiences with targeted propositions.

- Everyday essentials brands such as The Ordinary and Molton Brown are showing resilience with steady growth.

This variety of growth stories demonstrates just how competitive — and fragmented — the beauty landscape has become. Established giants may hold share, but smaller players are showing they can win loyalty and attention with the right positioning.

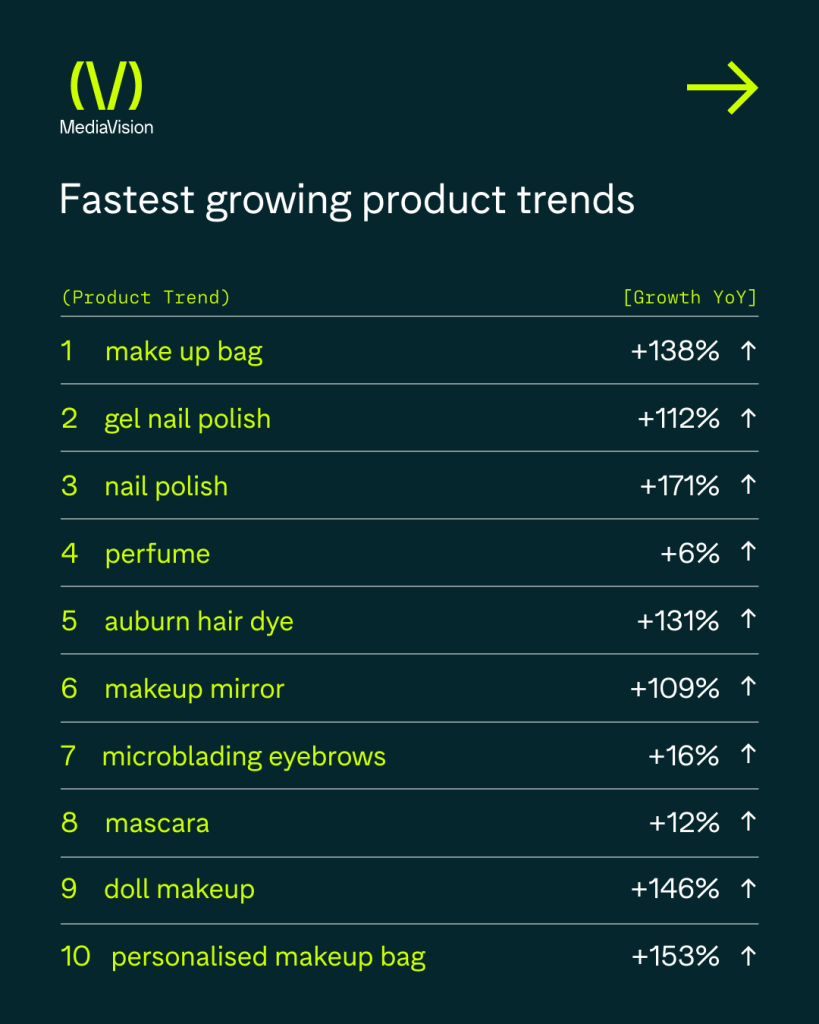

Fastest-Growing Product Trends

One of the most valuable things you gain with Metis is visibility into product-level trends. And right now, the data reveals categories aligned with gifting, self-expression, and lifestyle upgrades are flourishing.

- Makeup bags (+138%) and personalised makeup bags (+153%) are at the heart of the gifting surge.

- Nail polish (+171%) and gel nail polish (+112%) highlight the continued popularity of at-home beauty.

- Auburn hair dye (+131%) is capturing seasonal colour experimentation.

- Makeup mirrors (+109%) reflect lifestyle-driven purchases, as consumers invest in upgrading their routines.

- Viral-driven categories like doll makeup (+146%) demonstrate how Gen Z behaviour can quickly shape demand.

Even core staples such as perfume (+6%), mascara (+12%), and microblading eyebrows (+16%) are maintaining healthy growth. What this shows is that beauty shoppers aren’t abandoning traditional categories — they’re layering them alongside fast-moving trends.

What This Means for You

For CMOs and digital leaders, the takeaways are clear:

- Beauty is outperforming: The sector is showing resilience, with both brand and product searches trending upward despite broader retail headwinds.

- Products are leading the conversation: Giftable, lifestyle-led items are capturing outsized attention compared to broader category averages.

- Big brands remain strong but vulnerable: Boots is steady, but Superdrug has slipped, and disruptors like The Body Shop are finding room to grow.

- Challengers are rising fast: Cult Beauty, Rituals, and Huda Beauty prove that smaller players can build significant traction through focus and agility.

The underlying message? Shoppers are open to discovery. They want inspiration, choice, and relevance — and if you’re not visible when they search, someone else will be.

Stay Ahead with Metis

The difference between following the market and leading it lies in how quickly you act. With Metis, you can spot these shifts before they peak and move up to four times faster than your competition.

That’s the advantage of working with live, search-led data: you can identify emerging products, detect shifts in brand share, and capture intent-driven opportunities while others are still reacting.

So, whether your goal is to protect existing market share, capture gifting demand, or carve out space as a challenger brand, the insights are at your fingertips. All you need is the right tool to unlock them.

Get in touch with Media Vision today, and we’ll show you how Metis can unlock your next big opportunity in beauty.