Beauty Unlocked – Who’s winning the battle of the brands?

1. Market Overview: Consumer Intent Is Changing

The latest Metis data for the UK beauty sector points to a subtle yet significant shift in how consumers are discovering and purchasing products.

- Brand search is down 1.4% year on year, hinting at a gradual cooling of brand loyalty. Shoppers are no longer defaulting to familiar names — instead, they’re taking time to research, compare, and experiment.

- Non-brand, product-led search is up 3.28%, suggesting a growing appetite for discovery. Shoppers are looking for products that solve specific needs, rather than starting with a brand in mind.

This trend mirrors what’s happening more broadly across retail. As the cost of living continues to influence spending habits, UK consumers are becoming more discerning — prioritising value, versatility, and products that feel like small luxuries.

With the festive season on the horizon, beauty searches are turning towards gifting and self-care. Interest in makeup gift sets, perfume, and hair dye is climbing, as shoppers look for affordable yet indulgent presents that offer a touch of personal pampering. It’s a clear reflection of the “treat yourself” mentality that’s shaping post-pandemic retail, where consumers seek comfort and creativity without compromising on quality.

For marketers, this signals an important strategic pivot: winning in beauty now means appearing where discovery begins — not just when brand recall kicks in.

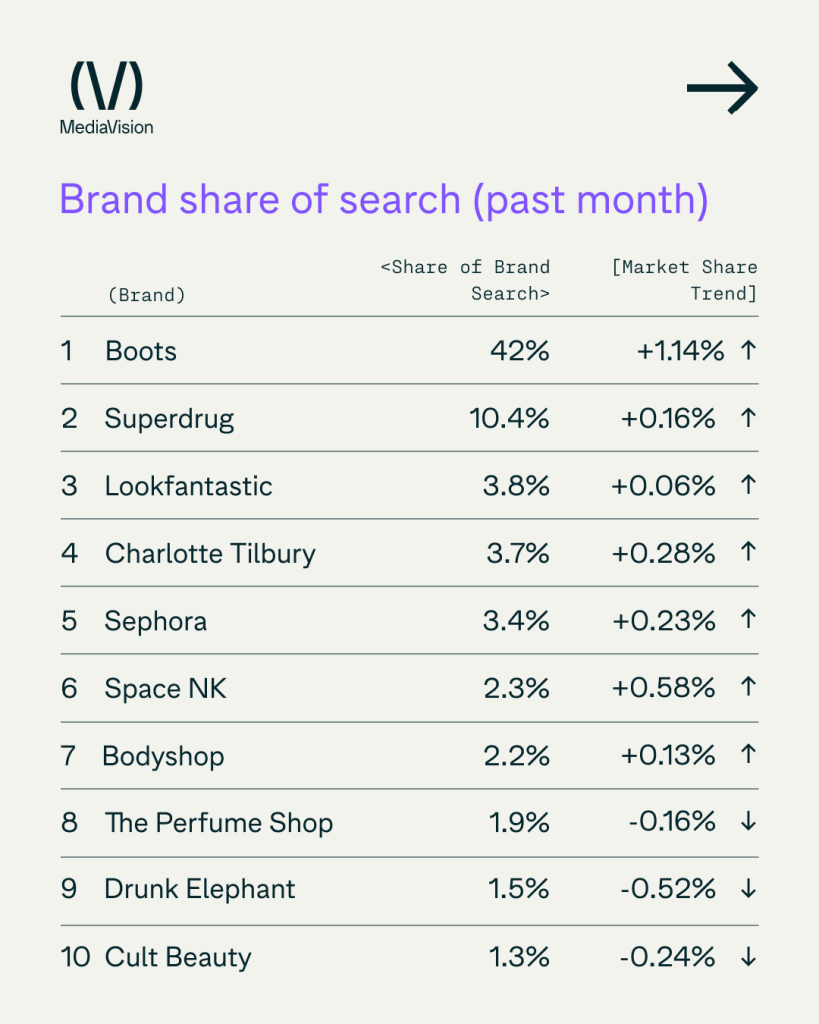

2. Biggest Brands: Boots Leads, Premium Beauty Rebounds

In a competitive and ever-evolving market, Boots continues to hold its position as the category leader. The retailer commands a 42% share of brand search, growing +1.14% year on year — a testament to its omnichannel strength, trusted reputation, and strategic investment in digital visibility.

Superdrug maintains its place in second, reflecting its continued relevance with younger, value-driven audiences. But perhaps the most interesting movement comes from premium beauty retailers, which are seeing a modest yet promising rebound.

Brands such as Charlotte Tilbury (+0.28%), Sephora (+0.23%), and Space NK (+0.58%) are enjoying renewed consumer interest — likely powered by early Christmas shopping campaigns, exclusive gifting ranges, and the ongoing allure of prestige beauty.

By contrast, The Body Shop and The Perfume Shop have experienced small declines, and Drunk Elephant saw the sharpest fall (-1.52%), hinting that the once explosive demand for hype-led skincare is starting to plateau. Consumers are maturing in their expectations, seeking results-driven products and credible storytelling over viral trends.

3. Fastest-Growing Brands: Accessible Luxury Wins

The strongest growth is coming from brands that successfully balance premium positioning with accessibility — those that deliver a sense of indulgence without the intimidation or price tag of high luxury.

Space NK (+0.58%) and Rituals (+0.30%) stand out as prime examples. Their blend of elevated in-store experience and approachable price points resonates deeply with consumers seeking small, meaningful luxuries.

Meanwhile, Charlotte Tilbury, Sephora, and L’Occitane are strengthening their positions as gifting favourites, thanks to beautifully curated packaging and a strong emotional connection with shoppers.

At the same time, Boots continues to grow — proving that brand equity and multichannel scale still matter. The retailer’s seamless integration of online, app, and in-store touchpoints keeps it front of mind, even as the market fragments.

Top Performing Brands (YOY Search Trends):

The pattern is clear: accessible luxury is thriving, and brands that inspire discovery through storytelling, sensory appeal, and thoughtful gifting are outperforming those reliant on legacy name recognition alone.

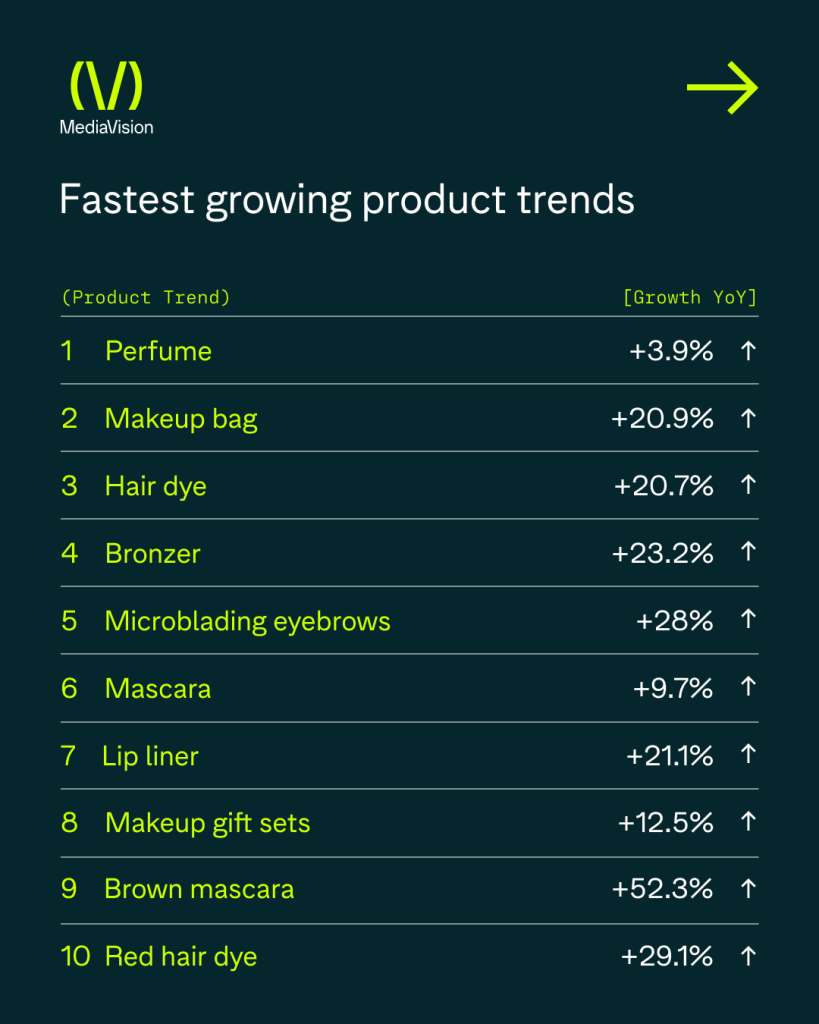

4. Fastest-Growing Product Trends: Gift-Ready & Self-Expression

When it comes to specific product trends, curiosity is strongest around items that deliver visible transformation or make ideal gifts.

- Brown mascara leads the pack, up a remarkable +52%, signalling a move towards more natural, understated beauty looks.

- Microblading eyebrows (+28%), red hair dye (+29%), and bronzer (+23%) all reflect consumers’ desire for self-expression and confidence through experimentation.

- At the same time, makeup bags (+21%) and gift sets (+12%) are surging, revealing how shoppers are already preparing for Christmas and seeking products that bundle value with presentation.

The takeaway? Consumers are embracing personalisation and playfulness — seeking products that allow them to curate their own beauty identity, whether that’s through bold colour, refined simplicity, or self-care rituals.

5. Key Takeaways for CMOs

The data tells a compelling story: consumer attention is shifting earlier and faster this year. With brand search softening and product-led discovery on the rise, SEO and content strategy must align to meet demand at the exact moment of intent.

The brands achieving growth are those combining speed, relevance, and storytelling — using insight to anticipate behaviour, not react to it.

As paid media costs continue to climb, organic visibility has never been more valuable. Optimising for search doesn’t just lower acquisition costs — it strengthens brand equity, builds authority, and frees budget for performance marketing or profitability.

In short, success in beauty now depends on understanding that discovery is dynamic. Consumers are no longer passively loyal; they’re actively exploring. The brands that stay visible, agile, and emotionally resonant will capture not just clicks, but lasting trust.

Now’s the time to ensure your beauty SEO strategy is running ahead of the curve — not chasing it. Get in touch with us to delve deeper into understanding brand and product positioning with Metis.